What can we help you find?

All the perks, none of the fees

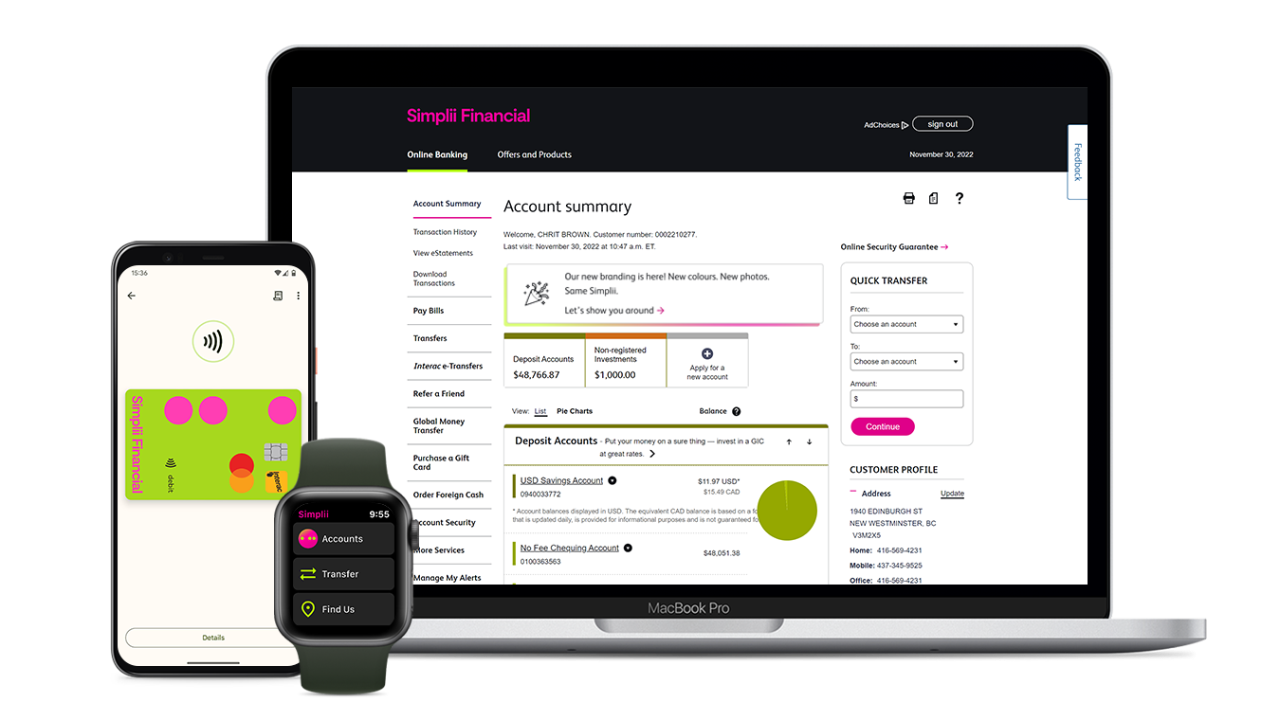

Bank with us anytime, anywhere. Manage your money online, on your phone or at any CIBC ATM with no monthly fees.

Life's busy. Keep things simple and enjoy no-fee daily banking without a minimum balance.

Latest features and updates

Find out about new and upcoming updates to get the most out of digital banking.

Digital banking simplifies life

Our commitment to you continues to be awarded

2024

Award-winning products

Winner of the Best Chequing Account

Winner of the Best Credit Card for Young Adults

Winner of the Best Credit Card for Newcomers

Bank without worry. We use multiple layers of protection to help keep your information safe.

Learn how to protect yourself from fraud and scams

Scammers are everywhere but it’s easy to stay safe with a few simple tips.

Can't find what you're looking for?

Use the arrow keys for suggested results.